Bitcoin saw a brief spike after the news of a 90-day tariff reduction deal between China and the United States. The price of the cryptocurrency briefly hit above $105,000 before dropping to around $103,410, reflecting investor wariness despite encouraging trade news.

Market Reaction to Tariff Reduction

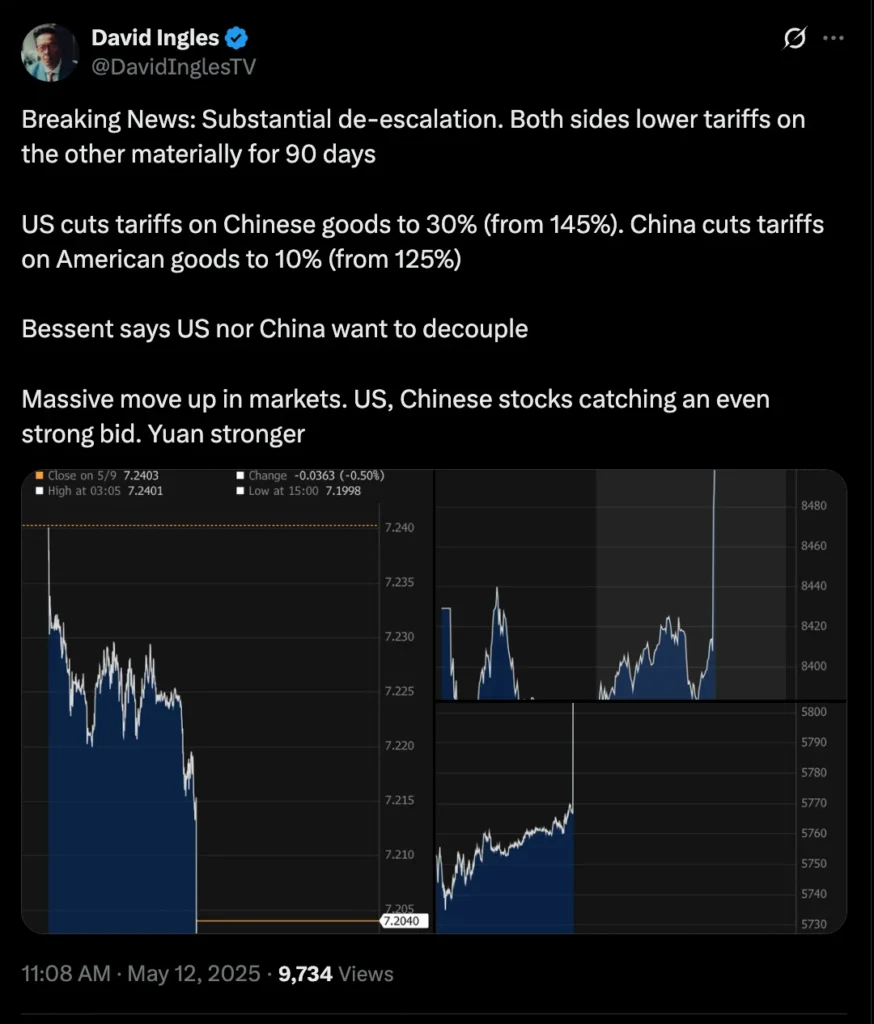

The fleeting relief of trade tensions, as the U.S. lowered tariffs on Chinese imports from 145% to 30% and China reduced tariffs on American imports from 125% to 10%, initially lifted investor morale in global markets. Bitcoin’s price reacted positively, as it does to macroeconomic signals.

But the rally was short-lived as investors reevaluated the wider implications of the deal. Fears over the temporary nature of the deal and its narrow scope caused a pullback in the price of Bitcoin. Analysts indicate that although the tariff pause brings short-term relief, it does not solve the underlying problems in U.S.-China trade relations, which are fueling market volatility.

Investor Sentiment and Market Dynamics

The early optimism has been tempered by the fact that the tariff cuts are only temporary and do not necessarily point to a longer-term solution. Investors have chosen to be cautious and uncertain, with some turning their attention to other assets. Altcoins like Ether, XRP, and Solana have registered interest, implying diversification among investors.

Also, the general economic environment, such as inflation worries and the possibility of interest rate increases, still drives investment attitudes. The function of Bitcoin as an inflation hedge is again being reexamined in the face of these events, which have been adding to its price volatility.

Also read: Coinbase Expands Wrapped Token Offerings with cbLTC, cbADA, cbDOGE, and cbXRP